In a landscape where digital connectivity has become essential, the roadmap to closing the digital divide demands a strategy guided by reliable data-driven insights. CostQuest’s CEO/President, Jim Stegeman, and Vice President, Mike Wilson, recently detailed in a webinar to the NTCA Rural Broadband Association (NTCA) membership the economic landscape of broadband and how to leverage data to help address the complexities behind broadband planning.

Below, we distill some of the key insights shared during the webinar, focusing on the role of precise data, cost drivers, and the strategic planning required to develop robust and effective broadband expansion plans. These are not just academic considerations; they are practical guidelines designed to help you make more informed decisions throughout the development of a broadband plan.

The Economics of Broadband Infrastructure

In a rapidly evolving digital world, broadband is no longer a luxury; it’s a necessity. An exponential rise in technological advancements, internet access, and higher bandwidth demand from consumers are key drivers in the internet becoming an essential utility. Yet achieving universal coverage remains a complex challenge, fraught with various economic considerations.

The role of data in broadband infrastructure planning has undergone a transformative change, and it’s important to understand the cost drivers, location density, and other key metrics affecting the broadband economic landscape.

Understanding cost drivers and key metrics

Cost data plays a pivotal role, and comprehending its contextual relevance is of the utmost importance. Prospective funding applicants and/or broadband planners must clearly understand cost determinants and establish essential metrics to effectively cross-verify project bids and cost estimations. Cost determinants such as cost of labor, materials, build complexity, and location density are some of the top drivers in cost that allow organizations to model the economic landscape of unserved and underserved areas.

With clear and comprehensive data, states are more empowered than ever to make intelligent choices. Wilson mentioned, “States will be armed with the data to help them understand economics at the structure level. Applicants won’t be able to cherry-pick locations,” emphasizing that there’s now a way to balance economic incentives with ethical imperatives.

As expected, most unserved locations face economic hurdles. To close the digital divide for all, not just in the attractive areas, states are strategically consolidating geographic areas to enhance commercial viability and optimize bidding efficiency. This involves devising a business-savvy approach to combine attractive and less attractive areas together to balance the economic value with the goal of providing broadband to all initiatives.

The Cost Density Factor

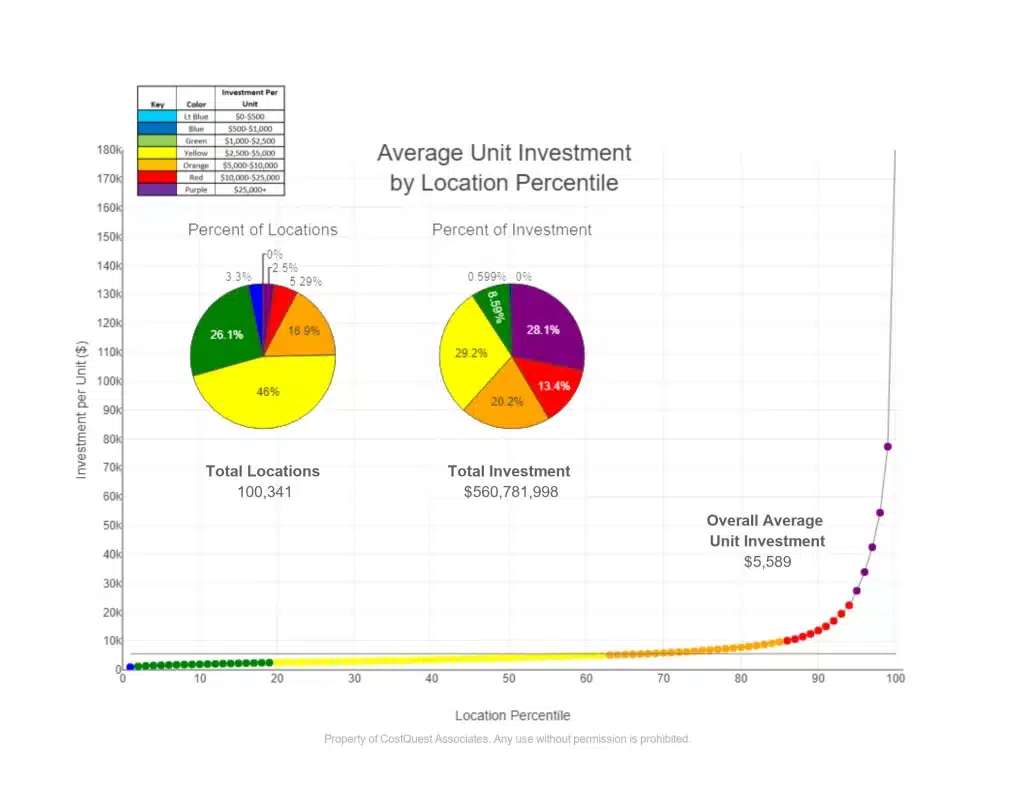

The concept of the Cost Density Factor is a crucial revelation that has emerged in the understanding of broadband expansion economics and describes how certain areas can become less attractive to service due to higher costs. As exemplified in the chart below, the seemingly modest purple portion on the graph corresponds to a relatively minor percentage of total locations but commands a greater portion of the investment, close to 30%.

This notion of the Cost Density Factor is indeed transformative, meaning a compact geographical area can wield substantial influence over investment allocation. For example, within State A of the graph, a mere 2.5% of locations translates to an impressive 28.1% of the total Fiber investment. This allows entities to reevaluate their strategic approach and sheds light on unique dynamics that underpin broadband infrastructure investments in higher-cost and less dense areas.

It’s important to note that cost and density are not the only factors to consider when reviewing the economic landscape of an area. More unique factors also need to be examined, such as the distance between location clusters, terrain, soil type, existing infrastructure assets (obsolete and useable), etc.

For example, if 1000 homes are near each other and considered a dense area, and that cluster is 50 miles from the next cluster of locations, then the high-density factor of the former location cluster value is lowered due to the incremental costs involved in closing the distance between clusters.

The Cost Density factor is designed to be a measuring stick to demonstrate the relationship between dense to less dense location clusters to ultimately highlight which areas are higher and lower cost, so planners can dive deeper into these areas to address unique variables and develop effective approaches.

How to leverage location and other information for broadband infrastructure planning

In the world of broadband planning, data isn’t just an asset; it’s the bedrock on which you build your strategy. CostQuest’s experts emphasize, “The success and quality of your broadband plan hinges upon the quality of the underlying data used to guide your decisions.” With the right data, not only can you make informed decisions, but you can also identify opportunities and manage risks effectively.

Today, the National Telecommunications and Information Administration (NTIA) and other federal agencies are better equipped than ever with robust data sets of information from consumer internet usage, demographics, internet service provider coverage information, and deployment costs. These are not just internal resources; they are shared actively with states and territories, streamlining planning and implementation at all levels.

Mike Wilson emphasized in the webinar, that data serves multiple purposes: “The data is there to support the Connect America Fund, BEAD, or other programs. Applicants can no longer use estimates or intuition to compete in these programs. For the granting authorities, the data minimizes waste and fraud, ensuring that broadband funds are put to optimal use, and digital equity and inclusion goals are met. Applicants need to follow suit and use real-world economics and precise data to be awarded funds.”

Let’s delve into the information and steps needed for effective broadband planning and why it’s indispensable for closing the digital divide.

Create a detailed Broadband Service Map

As emphasized by Stegeman and Wilson, “Comprehensive, granular, and reliable broadband information embedded into a broadband service map is crucial to effectively inform how to invest, plan, and design a broadband network as effectively as possible.” A well-defined broadband map acts as a compass. It helps in understanding the geography, the challenges associated with different terrains, and the areas that are in dire need of connectivity, thus helping drive well-informed decisions.

What data should you put in your broadband map?

The Foundation: Broadband Serviceable Location Data

For a map to be effective, it needs to offer granular geographic details. Broadband Serviceable Location data provides just that, offering geographic coordinates of all structures, including residences, businesses, and Community Anchor Institutions (CAIs), where a broadband connection can be installed. Adhering to the FCC definition ensures compatibility with federal funding programs.

Availability & Estimated Demand

When crafting a broadband plan, one crucial piece of data is the service availability (at what speeds) and the estimated locations in demand. This information reveals where service is lacking and the scale of unmet demand, thus guiding analysis efforts of service availability and consumer demand more effectively.

Understanding the Competitive Landscape

Being aware of internet service providers and the scale of competition in proximity to each Broadband Serviceable Location impacts take rates and adoption to capture the potential market share of each area. The competitive landscape is an essential piece of the puzzle when evaluating the commercial viability of an area.

Build Complexity

Assessing the relative challenges associated with deploying Fiber to a Broadband Serviceable Location necessitates a comprehensive consideration of factors like soil, composition, terrain characteristics, and labor conditions. This evaluation plays a pivotal role in determining the optimal sequence for deployment within specific geographic areas and informing the strategic approach to phasing the build-out.

Funding Areas

Knowing which funding programs can subsidize the costs of deployment is another piece of the puzzle. With accurate and comprehensive data, you can identify precisely how much funding is required, the additional capital needed, and from which sources.

Consumer Demographics

Understanding each area’s consumer demographics and psychographics is also critical information to gather to assess the unique demands and barriers each geographic area faces.

Considering variables such as average household income, household size, education level, price consumers are willing to pay for internet, why consumers are not online – whether it’s due to affordability, lack of access to adequate technology, etc. Taking into account the unique consumer profile of geographic areas can further the assessment of the likelihood of service adoption and affordability barriers of consumers.

What other information should you obtain in or alongside your broadband map to guide broadband planning?

A comprehensive Business Case and Cost Model – NPV is key

Exploring the intricate details of network expansion involves more than just calculating investment and projecting revenue; it demands a holistic understanding of the business case and its viability in the commercial landscape. As Mike Wilson elaborates during the presentation, “It is critical to build a comprehensive business case and cost model outlining: Initial Investment, Operating Expenses, Cost to Maintain Over Time, Capital Expenditure, Adoption Take Rates, and Revenue Potential. Now that Federal and State government agencies have new granular and robust information to support their grant planning and understanding of the funding needs at a detailed level. Applicants need to be able to do the same.

Data to include in business case and cost model:

Initial Cost Investment, Capital Expenditure, Operating Expenses, Maintenance Over Time

It can’t be stressed enough the importance of calculating both the initial and long-term costs involved. This includes costs to deploy Fiber or Fixed Wireless, and the associated maintenance costs over time to understand the full business case of serving a geographic area.

Service Adoption

Your planning should also include expected service adoption rates for a serviceable area and the factors that might reduce these rates. Knowing this can save you from future financial pitfalls.

Revenue Potential

Understanding the Average Revenue Per User (ARPU) across different geographies, customer types, subscription plans/bundles, etc., helps refine your business model and set realistic financial expectations.

Building a self-sustaining Business Case (w/o Public Funding)

Understanding the Net Present Value (NPV) on a regional basis provides insights into both commercial viability and the requisites for cost recovery. Another aspect to consider involves identifying potential residuals required for public funds to establish a business case that aligns with the company’s objectives.

Prioritize Network Build

Deciding where to build first could be the difference between a thriving network and a financially unsustainable one. “Considerations of where and how to prioritize your network build can ultimately benefit your network business the most; identifying commercial viability holds the key,” says Jim Stegeman. ”CostQuest’s data and analytics services aim to help you make these determinative choices based on a range of key factors.”

Understanding the specific challenges posed by each potential build area is essential. What areas are the most feasible to build to? What areas are high-cost and have barriers to build to, factoring in protected lands, potential permits needed, and terrain?

Mike Wilson explains, “Certainly, density is typically at the top of the list of drivers for viability. The inverse relationships between cost and density need to be understood, and the consideration of public funding opportunities needs to be measured.” Planning a broadband network that is both effective and economically viable is a nuanced process. It requires a deep dive into data, the development of a strong business case, and strategic decisions about where and how to build.

Identify and qualify locations near your existing service area that need broadband services

Don’t spread resources too thin. Focus on areas that are closer to existing service territories but are still unserved or underserved. The National Telecommunications and Information Administration (NTIA) and states are arming themselves with quality data to aid their broadband planning initiatives to provide broadband service to all. The goal is to create a balanced portfolio of locations, including attractive/easier-to-serve and less attractive/more challenging areas. This approach ensures that you’re not just cherry-picking the low-hanging fruits but also contributing to the broader goal of closing the digital divide.

Closing remarks

The journey to bridge the digital divide is packed with complexities that extend far beyond mere technological capabilities. It is a tightrope of economics, geography, and data-driven strategy. The stakes are high, impacting everything from educational equity to economic development. As we move deeper into an era where broadband is a staple rather than a luxury, the responsibility of making informed decisions weighs heavily on every stakeholder involved.

CostQuest’s experts, Jim Stegeman and Mike Wilson emphasized in their webinar that leveraging multi-dimensional datasets, understanding nuanced cost drivers, and incorporating metrics like Cost Density Factor and NPV can make or break your broadband expansion strategy. Each piece of data you gather in your planning process is a building block to help you construct a scalable, sustainable, and socially responsible broadband infrastructure project.