U.S. mobile broadband coverage, competition, and signal quality reveal how 5G, fixed wireless, and satellite partnerships are reshaping connectivity across urban and rural America.

This Broadband in America: Mobility Market Focus report, part of the Broadband in America series, delivers a data-driven analysis of the U.S. mobile telecommunications market, using the FCC’s Broadband Data Collection Versions 5 and 6 and CostQuest’s® Location Fabric and network cost models. It examines mobile coverage by land area, Broadband Serviceable Locations (BSLs) and road mileage, competition, technological evolution, and signal-strength performance across more than 92 million H3 hexagonal cells, providing a granular, nationwide view of the mobility market

Mobile service covers 70% of U.S. land, yet less than 20% have high signal strength

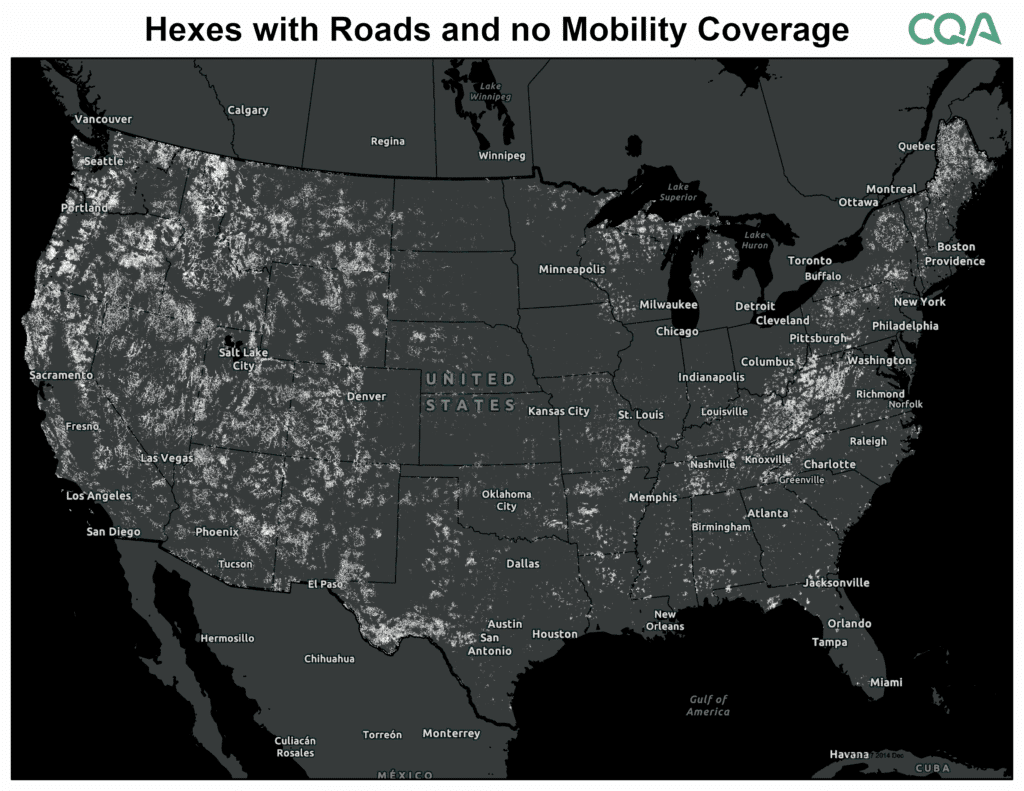

The report details how mobile coverage now reaches more than 70% of U.S. land area and 92% of road miles, with 97% of hex cells containing broadband serviceable locations showing mobile service availability. Yet fewer than 20% of U.S. land area benefits from high signal strength, underscoring a persistent quality gap between rural and urban markets, where nearly all urban hex cells are covered and strong signal is concentrated.

Verizon, AT&T and T-Mobile hold large market share of mobility market; Growing effects from partnerships and mergers

The mobile market structure remains dominated by the three national carriers – Verizon, AT&T and T-Mobile – which overlap extensively and collectively cover most of the country’s mobile footprint. More than 61% of covered hex cells have three or more providers, indicating robust competition on coverage, even as high spectrum and infrastructure costs limit disruptive new entrants. The report traces the effects of mergers on the mobility market, including T-Mobile’s acquisition of Sprint and the emergence of Dish as a fourth facilities-based carrier, and evaluates how cable and satellite partnerships are reshaping pricing, bundling and rural reach.

5G deployment enhancing connectivity, 6G and satellite integration on the horizon to potentially close service quality gaps

Finally, the report assesses 3G, 4G and 5G deployment patterns, highlighting how mid-band 5G and cell-site densification enable both enhanced mobility and fixed wireless broadband, particularly in urban areas. It concludes with a forward-looking assessment of how satellite integration and eventual 6G deployment could close remaining coverage and quality gaps across diverse American communities.

Click here to read the full Broadband in America Mobility Market Report.